Grocery sector gains are sustained into 2021, as basket sizes continue to increase

There is no question that spend in the Grocery sector has been elevated as a result of the pandemic – the real questions are by how much, and how that will change in 2021. Fable Data tracks real-time consumer spending, allowing us to provide valuable insights into the Grocery sector.

Seasonal fluctuations accentuated by COVID in Q4

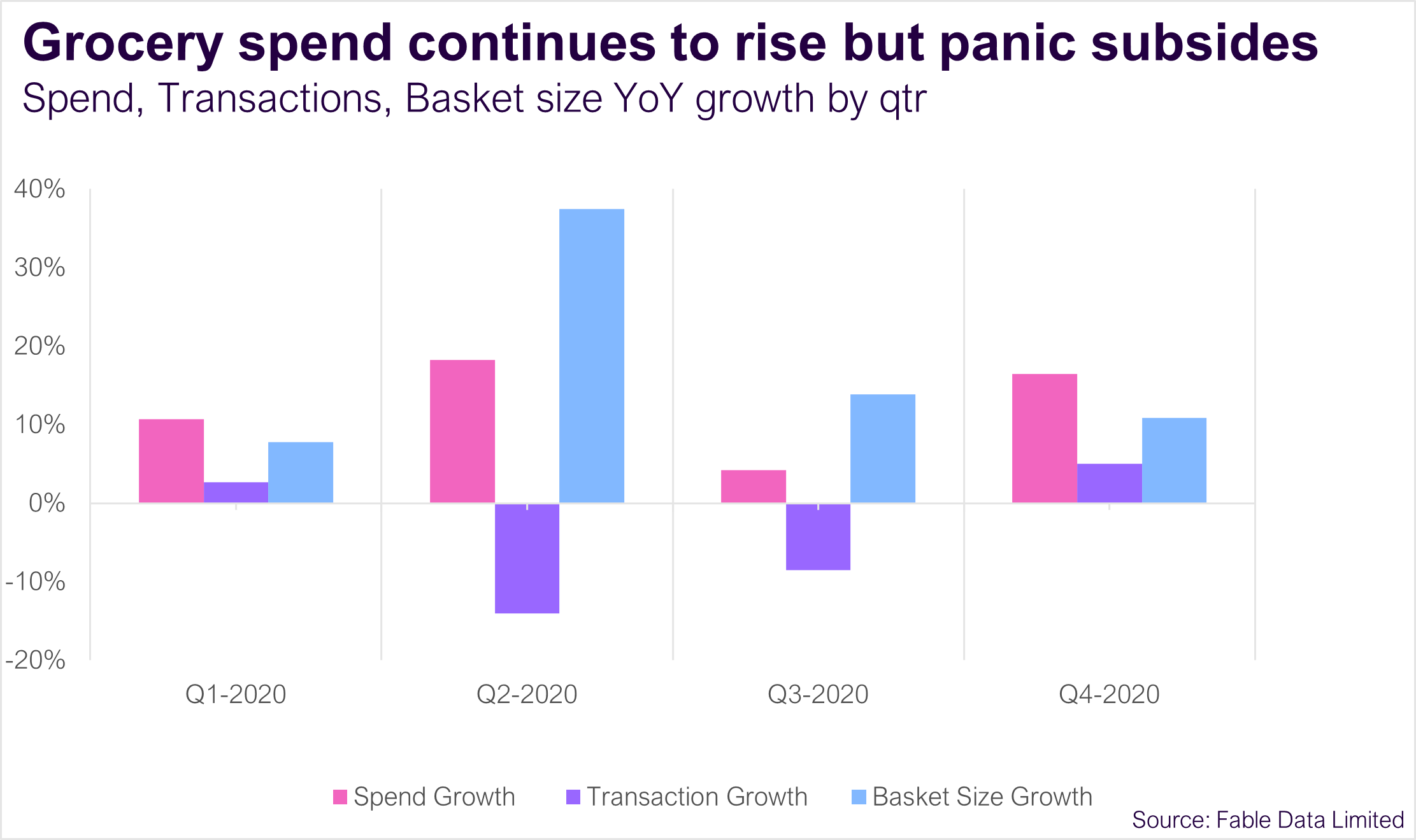

In 2020, Grocery spend was up c. +12% YoY. The highest growth for this sector was seen in Q2, with spend up c.+18% YoY, as lockdown restrictions were put in place. Q2 2020 was characterised by increased basket sizes at +38% YoY, as consumers made fewer trips to the store but raced to combat declining stock volumes, fuelled by spreading feelings of uncertainty and ‘panic buying’. Through Q3 and Q4 panic subsided as basket size growth was more moderate at +14% and +11% YoY respectively. Q4 spend, which typically hallmarks a peak spend period for Grocers, was another strong quarter of growth (up +16% YoY). During this period, transaction numbers were above 2019 levels by c.+5% YoY, following declines in Q2 and Q3.

Grocery spend on pace to surpass 2020 spending levels

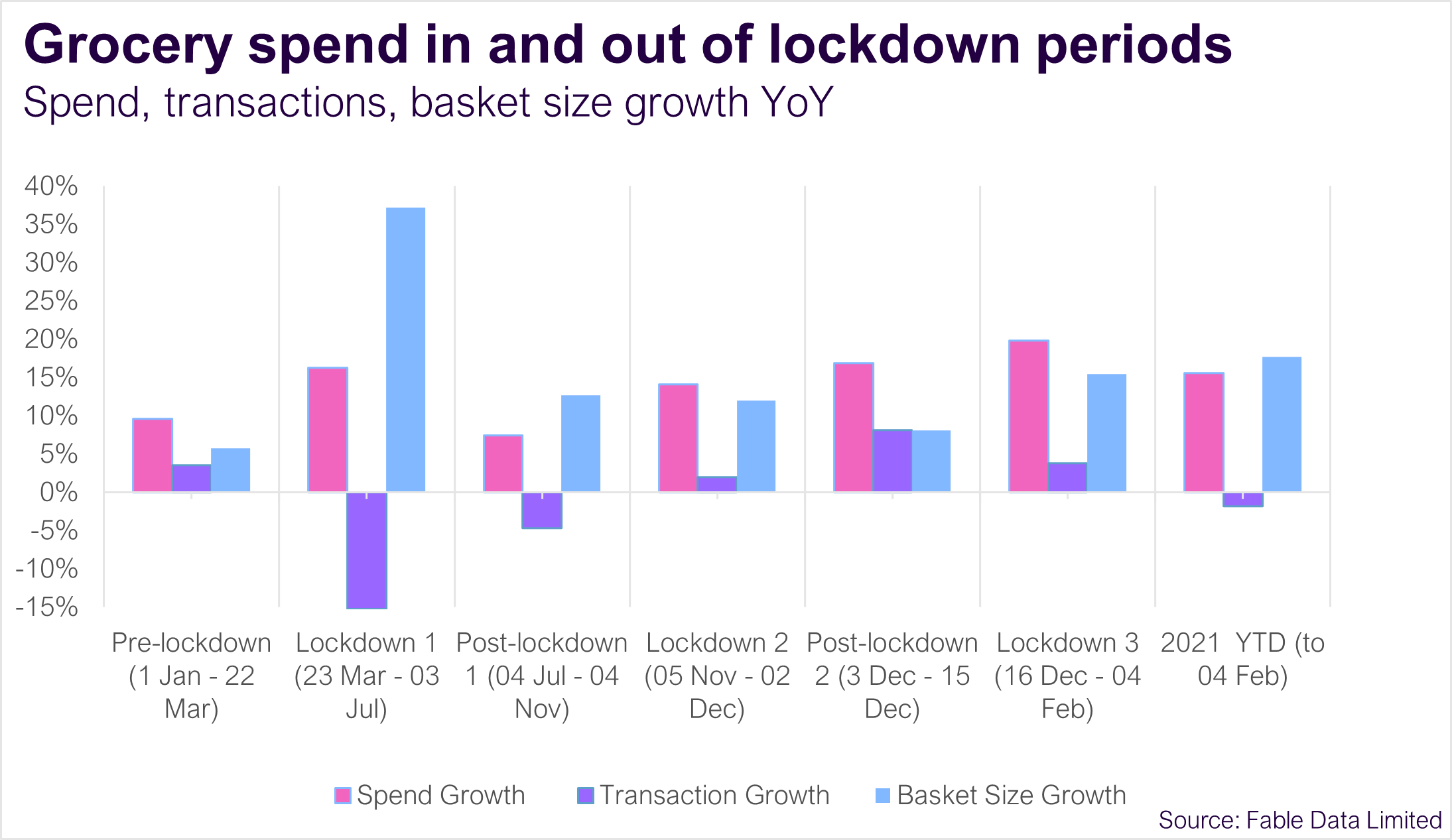

- Current lockdown period (16 December onwards): Fable Data highlights that Grocery spend has increased at a higher rate (c.+20% YoY), compared with the initial lockdown period. This reflects a mix of both increased online capacities, with transactions growing at +4% YoY, and increased basket sizes, as families re-adapted to further lockdown measures, over the peak holiday period.

- Q1 (to 04 Feb): The momentum from a strong holiday trading period has continued into the new year. Like the trend through 2020, the share of online spend continues to track to new highs, with the share of online spend through 2021 in the mid-teens.

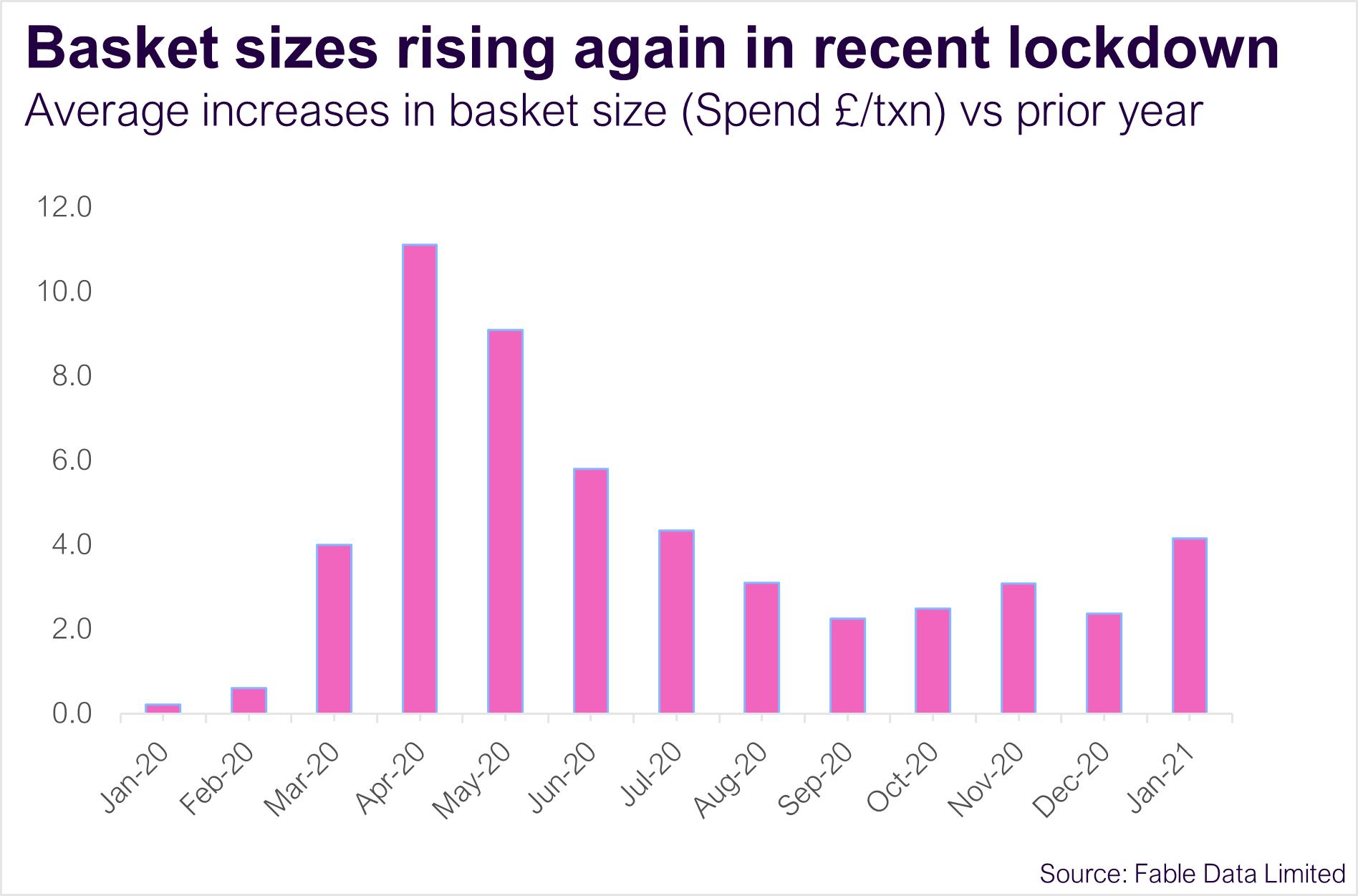

- With transactions down slightly YoY in January 2021, we are once again seeing the dynamics of higher basket sizes contributing to spend growth. On average transactions are up by c.£4.2/transaction (YoY), the largest YoY increase since June 2020.

- The combination of grocery companies adapting to higher stock demand and more rational consumer buying behaviour continues to see spend track higher across the sector through Q1 2021. With this in mind, and restrictions still ongoing through Q1 2021, the Grocery sector is poised for another strong quarter of growth.

Join us at the Neudata, Consumer Discretionary & Staples event, this February 11th 2021, as our analyst Avinash Srinivasan dives deeper into the Grocery sector across 2020, including the latest figures for January 2021.